Tempo de leitura: 7 minutos

The FDI angle

- Global free zones saw record-breaking FDI in 2023, comprising nearly 5% of all FDI projects worldwide.

- Multinationals increasingly rely on SEZs for stable infrastructure and market access amid global disruptions.

Why it matters: Rising geopolitical tensions and protectionism push companies toward SEZs for predictable environments, crucial infrastructure, and strategic market access, making them key FDI drivers in global supply chain reconfigurations.

Multinational companies are discussing and investing in free trade zones (FTZs) more than ever before as they navigate a world beset with rising geopolitical tensions, protectionist policies and industrial transformation in everything from digitalisation to the energy transition.

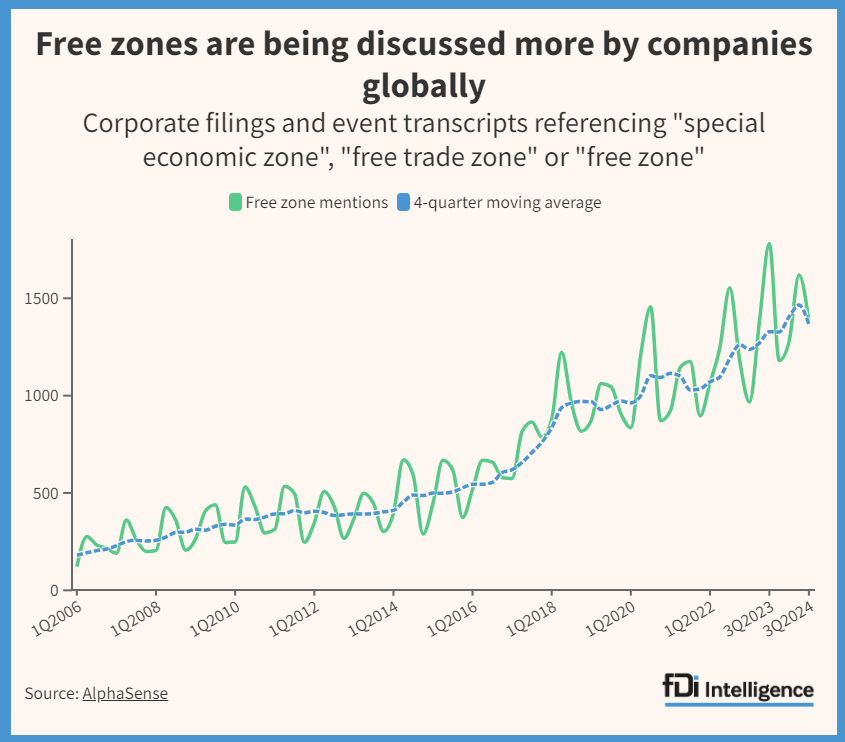

The number of global corporate filings and event transcripts mentioning either “free zone” or its derivatives like “free trade zone” or “special economic zone” has risen steadily since records began in 2006, hitting an all-time high in the third quarter of 2023, according to AlphaSense, a data provider.

This rising interest in special economic zones (SEZs) goes hand in hand with increasing levels of investment flowing towards them.

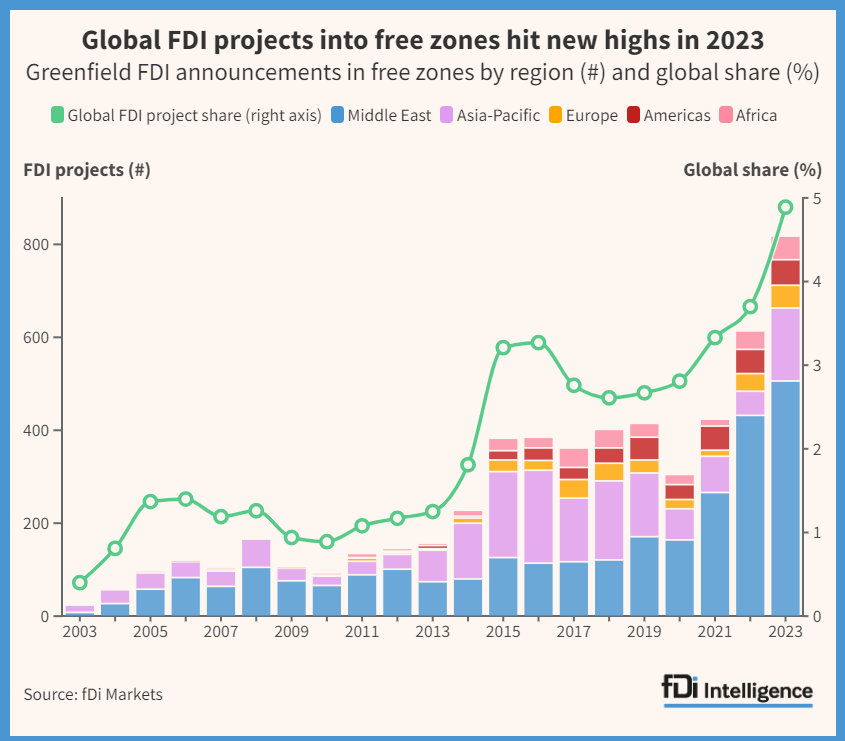

The number of greenfield foreign direct investment (FDI) projects announced in global free zones broke records in 2023, according to fDi Markets, which has tracked investments in more than 1000 SEZs around the world. Almost 5% of all FDI projects announced last year worldwide were made in FTZs, up from 3.7% in 2022 and the highest ever share of global FDI since records began in 2003. While free zones in the Middle East attracted the most FDI projects, every global region attracted more free zone FDI pledges in 2023 than a year earlier.

“Free zones will be very important in the next 10 years,” says Martin Ibarra, an adviser to the board of the World Free Zones Organization (WFZO). “There is a reconfiguration of global chains to regional chains. Free zones give the perfect environment of ready infrastructure, buildings and duties exemptions [for investing companies adjusting their global footprints].”

A vast universe

The vast universe of SEZs, or geographically demarcated areas that provide special conditions for businesses, is incredibly varied with a wide array of definitions and acronyms. The diversity of SEZs, which differ by governance, type and intensity of incentives, target sectors, and services offerings makes it difficult to accurately capture the levels of business activities within them.

The WFZO counts as many as 7000 SEZs worldwide, while Adrianople Group has identified 4921 active zones in more than 90 countries. Meanwhile, the OECD estimated in 2019 there are about 3500 globally.

“It’s difficult to track them and to know which zones have actually entered operations and are successful,” explains Maria Camila Moreno, a policy analyst focused on FTZs at the OECD and the former executive director of the Latin American Free Zone Association.

Despite the difficulty in accurately outlining the contours of this universe, many SEZs have come a long way from early free zones models. Experts argue that the maturation of many SEZs to offer more advanced infrastructure and services is part of their growing popularity among multinationals. There is a trend towards “new-generation zones”, which tend to be bigger, more integrated with local economies and less reliant on fiscal incentives than their earlier counterparts, according to Imane Radouane, an SEZ expert who has worked for Unctad and the Africa Economic Zones Organization. “The evolution of zones towards larger, more integrated models may be attracting a wider range of investors,” she says.

The proliferation of SEZs as a tool to attract FDI and foster economic development has also allowed successful zones to become a more prominent force in an increasingly fragmented global economy.

“There are already so many uncertainties in the global economy today. Special economic zones provide that predictability in terms of a stable business environment,” says Douglas van den Berghe, CEO of NxtZones, an SEZ-focused consultancy.

A confluence of factors

Beyond this natural evolution of SEZs worldwide, a confluence of factors has pushed multinationals to reconfigure their global footprints in recent years and further increased the strategic value of SEZs.

Governments have become more active in trying to shape trade and investment, particularly since Covid-19 exposed vulnerabilities in supply chains for everything from healthcare to technology. In 2023, the global number of new “harmful” industrial policy interventions rose to 2224, according to Global Trade Alert. This was more than three times the number recorded in the pre-pandemic year of 2019; and almost four times higher than the 574 “liberalising” new measures implemented in 2023.

Andreas Baumgartner, CEO of the Metis Institute, an advisory firm, says that even though free zones “can’t insulate themselves” from growing protectionism, they can provide “predictability and transparency” in uncertain times. “[Free zones] are eager to provide an environment that companies can trust and that inspires innovation,” he adds.

A rise in geopolitical tensions and major conflicts in Europe, the Middle East and Africa are also on investors’ minds. Some 85% of 516 global business leaders surveyed by Kearney in January 2024 think that an increase in geopolitical tensions will affect their investment decisions. Many companies have decided to engage in friendshoring, when they invest in allied countries, as well as build new production capacity closer to their end consumer markets, also known as nearshoring. Other companies have also engaged in tariff jumping, setting up new operations in target markets and countries with access to them to avoid duties imposed on their goods.

“One attractive feature of many SEZ regimes is the preferential market access they offer.,” says Susanne Frick, a lecturer in economic geography at Cardiff University who has done extensive research on SEZs. “This means firms can export to certain countries paying lower tariffs, or none at all, than they have to pay if they produce in their own country.”

This is echoed by other academic experts. Andrés Rodríguez-Pose, a professor of economic geography at the London School of Economics, says that the free zones have become “increasingly vital” for companies seeking to navigate challenges. “As trade policies grow more restrictive and the risk of supply chain disruptions increases, businesses are turning to free zones, considering them safer havens that offer greater stability and predictability,” he explains.

Many SEZs offer a one-stop shop that can save foreign investors time to set up new operations by offering access to services, facilities and ready-built infrastructure. “It’s faster, more efficient and more workable,” says Hussain Al Nowais, chairman of UAE-based renewables developer AMEA Power, which has a memorandum of understanding to produce green ammonia in the Suez Canal Economic Zone, Egypt. Mr Al Nowais also oversees his eponymous family-owned conglomerate with business interests in real estate, ICT, healthcare, engineering and construction.

In a world with major policy uncertainty, advisers argue that SEZs offer a way for companies to mitigate risk in their operations and make their supply chains more resilient to shocks. “Investing in an SEZ or FTZ somewhat insulates companies from new customs, tariffs or [policy changes] that might come up,” says Seth Martindale, senior managing director of Americas consulting at real estate advisor CBRE.

Green energy hubs

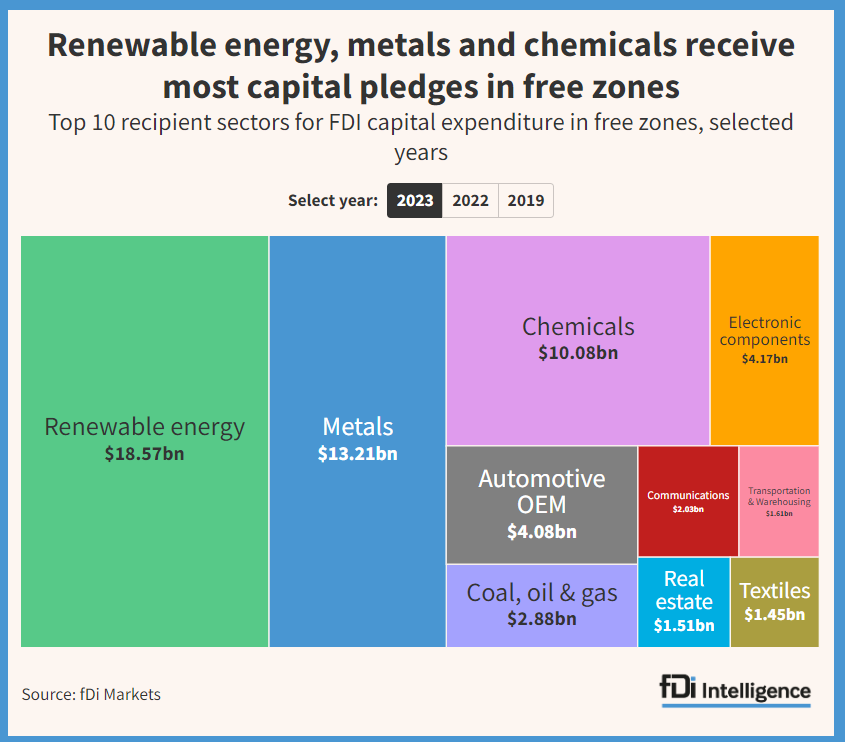

Free zones are also broadly reflective of global investment trends across industries. Renewable energy was once again the largest recipient sector of greenfield FDI in free zones, with projects worth more than $18.6bn tracked in 2023 alone, according to fDi Markets. This was down from the record $61.6bn of renewables FDI pledges recorded in free zones in 2022, reflecting less large, speculative agreements signed for the production of green hydrogen in FTZs.

On the flip side, several sectors had more FDI announcements in free zones in 2023 than a year earlier, including metals ($13.2bn), chemicals ($10bn), automotive OEM ($4bn), coal, oil and gas ($2.8bn) and communication ($2bn). The last of these reflects a greater number of data centres set up in free zones across the world.

Oliver Cornock, managing editor of Oxford Business Group, a research and consulting firm, believes that higher industrial investment in free zones is reflective of some developed countries becoming expensive with more complex, regulatory frameworks. “When it comes down to the bottom line and you’re setting up an industrial business, [simpler regulatory frameworks offered in free zones] is a major factor in their attractiveness,” he says.

Fonte/Foto: FDI Intelligence

Os comentários foram encerrados, mas trackbacks e pingbacks estão abertos.